In times of crisis, inflation, or economic uncertainty, investors turn to gold to protect their principle. The precious metal has historically always been considered a safe purchase, with positive price elasticity – meaning that demand and price rises correlate, a rare occurrence, and a safe bet, especially during a shaky economy.

What that means for the common man, then, is that gold in the family is a safety net: from immigrants putting the family money into a single, solid gold pendant for safekeeping during their journey, to mothers snipping links off a gold chain for bread to feed their children, to a gold watch that, when sold, could mean the difference between shelter and homelessness.

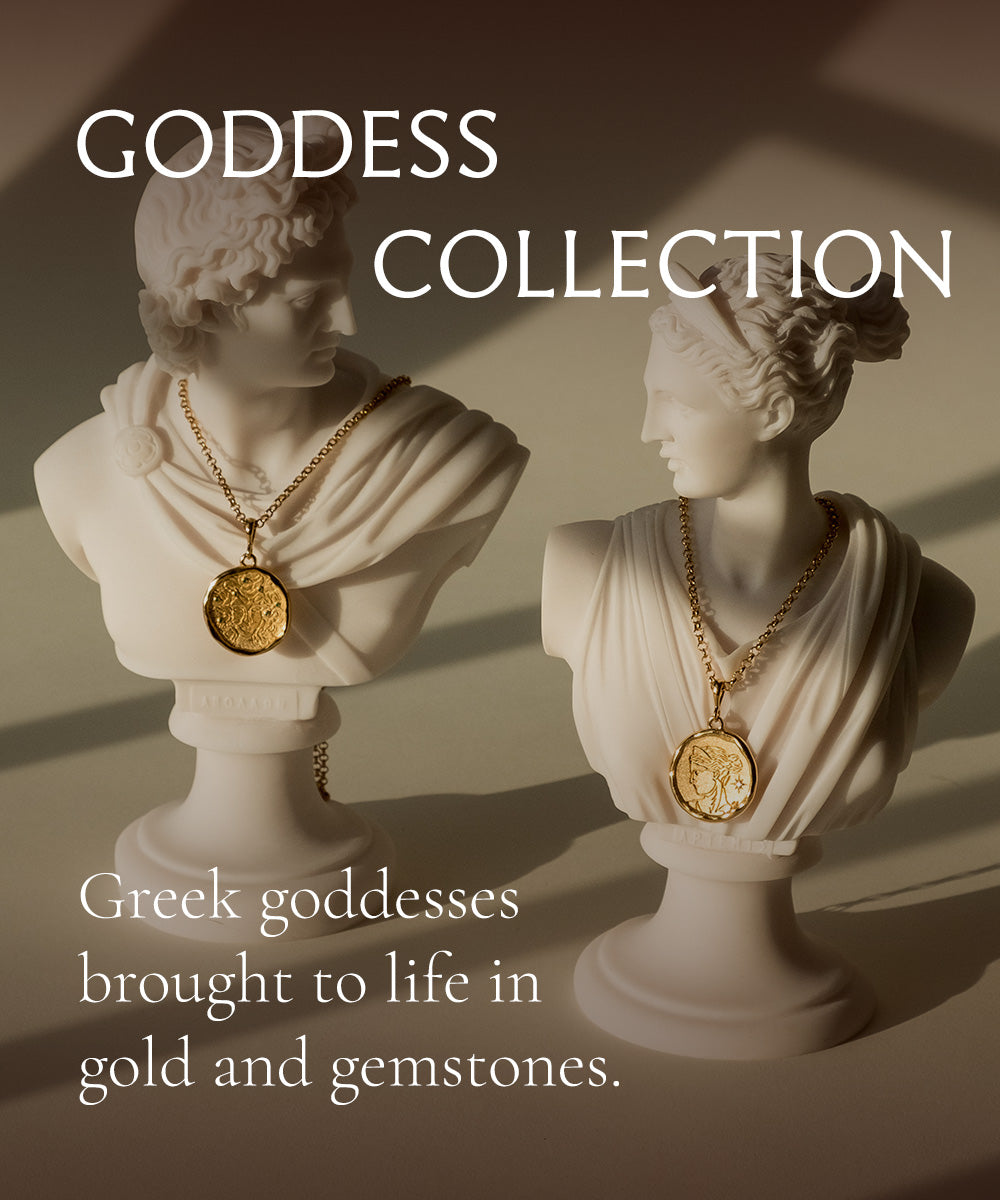

The economic value aside, gold persists. The gold you wear over your heart and on your finger is the same gold that was once worn in tiaras on the brows of ancient queens, brushed onto gilded statues of goddesses, passed down from prudent mothers to ensure their daughter’s financial protection, and gifted by fervent lovers as signs of everlasting love and security. It was traded across miles and miles of stone and sand, melted down and recast, and with each new life it took on, gold has offered stability, comfort, and breathless excitement to the wearer. Precious, gorgeous, and as old and bright as the sun, gold persists.

We cannot predict what the future will hold, but we know the past. Gold is, has always been, a tangible investment. While portfolios are down, inflation is up, and stagnant wages cause buying power to dwindle, some may feel there is reason to panic sell – but think ahead. Where will you be in ten years? Twenty? Where will your family be? If you’re going to invest, do so not in a moment of impulse, but in a way that will benefit you and yours for years – even generations to come.